How to Select the right Refinance Lender?

Lenders Evaluation: Prices

When deciding on a lending company, the key items to consider was can cost you and you can features. Understanding the terms of the loan-the fresh new payment per month amount, the amount of age up to it is paid, the pace, charge, and you can even when a punishment are accessed for those who pay from the financing early-will offer understanding of various will set you back.

Conversations along with your potential lender or mortgage broker, together with a glance at the truth when you look at the Financing Operate (TILA) and you can closure disclosures, will enable you and make a fair testing. The latest disclosures are legally required to safeguard individuals by demanding loan providers to provide standardized disclosure of one’s costs associated with a loan.

The details include the rate of interest, financing charge, the quantity financed, plus the final number regarding costs. Late commission fees and service charges are announced. The fresh closing disclosure contours the latest closing costs, and additionally one costs having an attorney, term research, and you can bodies taxes.

The situation within the https://www.paydayloanflorida.net Financing Work (TILA) and you will closure revelation can provide you with rewarding suggestions when you compare loan providers while offering because the interest rate and you may service costs is also are different anywhere between lenders. Following that, you will see the full costs and exactly how much home loan your are able to afford. A mindful report on the new rates on the loan providers will help you can see a knowledgeable offer.

Mortgage brokers Analysis: Service

Refinancing a loan requires a lot of paperwork, and also the range and you can dissemination from a great deal regarding information that is personal. Having an individual, reputable area from get in touch with to suit your inquiries can make the difference ranging from a smooth, easy procedure and you may a difficult experience.

Some functions to look for become prompt and you will direct solutions to help you the questions you have. Obtaining the financing able over the years to suit your closure is another important consideration. Latest documentation can often be not available up to days-if you don’t times-through to the closing, and you may complimentary the latest schedules of the numerous people mixed up in transaction should be problematic. A trusted bank can help keep all things focused and you will timely and also make a life threatening contribution on private tranquility from attention.

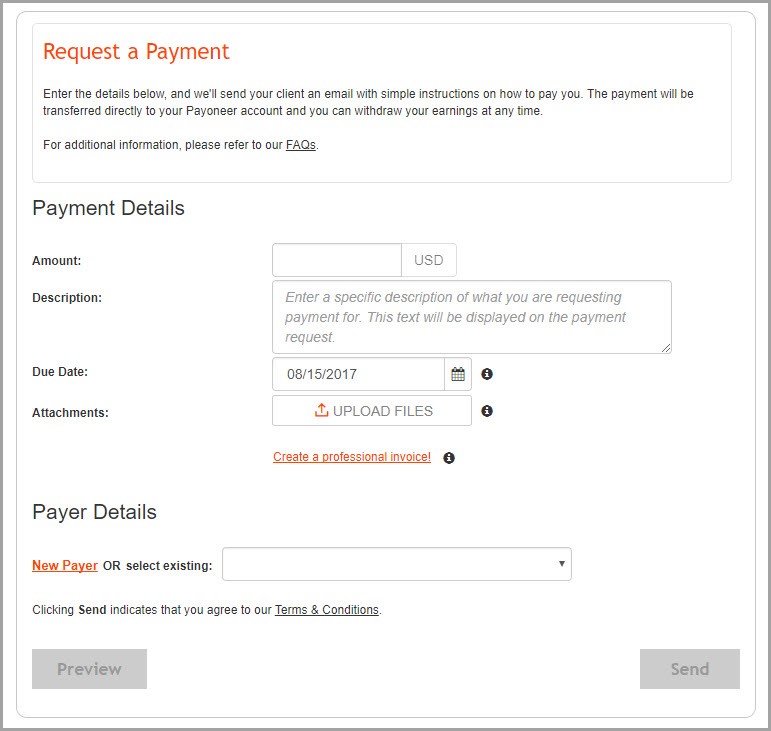

At the same time, evaluating and you may gathering all the information you wanted to re-finance is a beneficial time-taking processes demanding check outs so you’re able to multiple lenders or hours for the cellphone. When you’re people traditional options are nevertheless readily available, tech has made the method smoother. You could use the internet evaluate loan providers and obtain insights on all of the rates readily available for the borrowed funds you will be trying.

It’s important to seek information and compare the expense and you may qualities of numerous loan providers. Make sure to examine the brand new loan’s interest, fees, and you may settlement costs.

Might you Refinance a home loan With Any Bank?

Sure. You don’t have to re-finance the home loan together with your latest bank. You might examine and you may look for the loan lender you to definitely better suits your financial situation.

Whom Must i Contact to help you Refinance My Financial?

Label your current financial observe whatever they offer for refinancing possibilities, but compare offering with other loan providers. You can even register the help of a mortgage broker just who, getting a fee, can help you select a loan provider that gives your best option for your requirements-be it a minimal prices and/or finest service.

The conclusion

Refinancing the home loan can also be, underneath the right situations, end up being an economic boon to possess adding extra deals towards handbag. Before you can continue the method, regardless of if, you should thoroughly discover refinancing in order to make sure its right for your specific condition.

This type of actions encompass choosing whether or not to have fun with a loan manager otherwise large financial company, searching for a loan provider, calculating will cost you, and you will determining who can deliver the greatest services. Luckily for us, online resources make business much easier today than just it put getting. Thus control the procedure and discover what you could save your self.

Be it a lending company otherwise representative, certain analysis hunting and you may research can supply you with a little while of knowledge so you can spend less and acquire an informed fit for debt needs.