Understand Dangers of the new Tax-Deductible Home loan Means

- Feel mortgage-totally free less: The point where you are theoretically home loan-totally free occurs when your investment portfolio are at the value of the an excellent obligations. This needs to be faster than which have a traditional financial since the investment portfolio will likely be broadening because you create mortgage payments. The mortgage payments generated utilising the proceeds of the income tax write-offs will pay down the home loan even more quickly.

- Build a financial investment collection whenever you are paying the house down: This is a terrific way to start rescuing. It also helps free up bucks that you may otherwise not was in fact capable dedicate just before paying the mortgage.

One very important point out mention is the fact this strategy isnt for everybody. In fact, it can be risky otherwise can navigate they. Lost or skipping a home loan fee you are going loans Webb AL to derail any progress. Borrowing from the bank facing your home are going to be mentally hard. Even worse, in case your opportunities don’t produce the newest questioned productivity, this strategy could yield bad efficiency.

Because of the lso are-credit the fresh new collateral in your home, youre removing your own cushion from security in the event the a home or resource places, or one another, bring a turn on the worse. By simply making a living-producing portfolio inside the an unregistered membership, you could face more tax consequences.

Make sure you speak with a specialist monetary mentor to choose whether this tactic is actually for your. If it is, feel the professional help you personalize they with the along with your family’s private financial situation.

Exemplory instance of an income tax-Deductible Canadian Financial

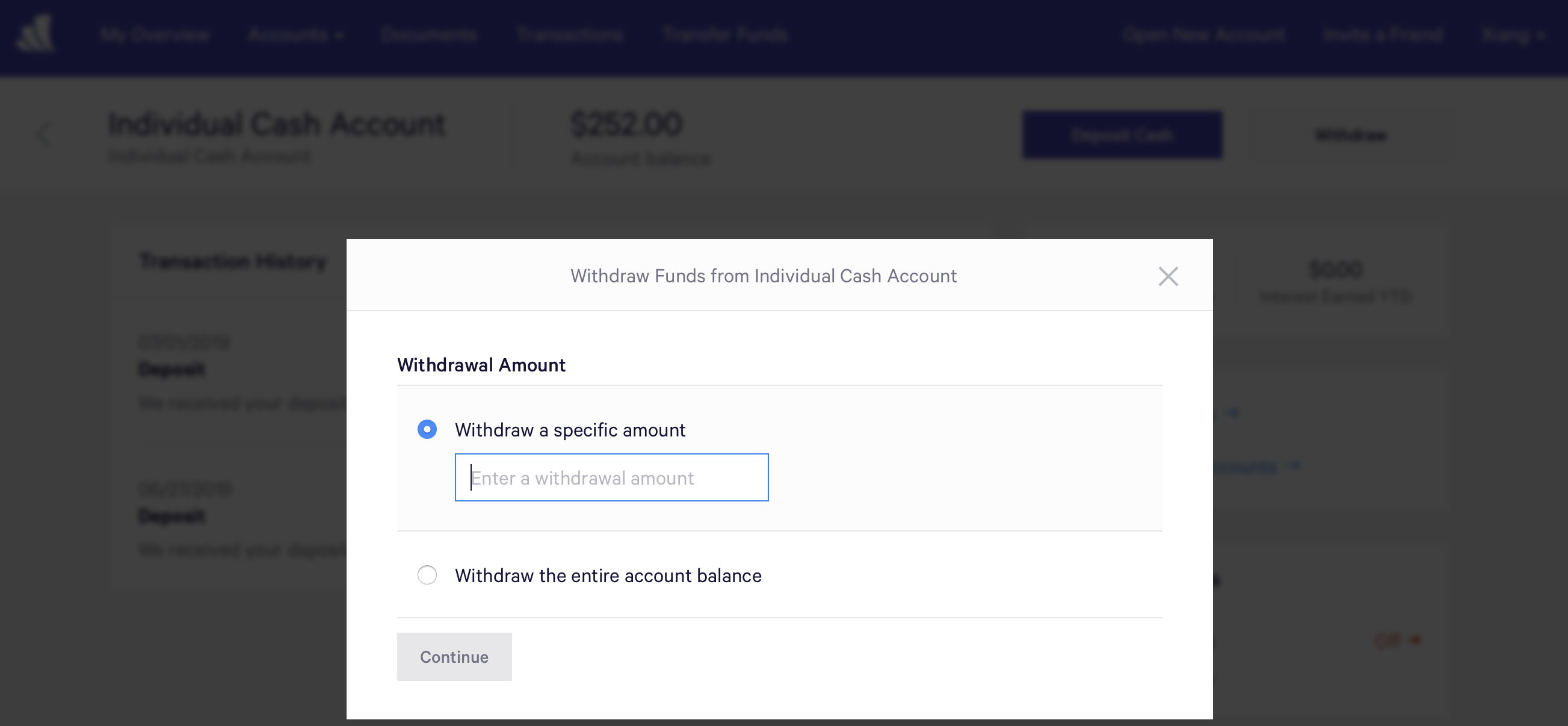

To spell it out this most readily useful, refer to brand new example lower than, where you could notice that the loan percentage of $step 1,106 four weeks contains $612 in the prominent and you can $494 for the desire.

As you can see, for each commission decreases the balance due toward mortgage of the $612. After every fee, the brand new $612 is actually lent back and invested. This features the total obligations height on $100,000, although portion of the financing which is tax-deductible expands with every payment. You will see on a lot more than contour that whenever 30 days off using this tactic, $99,388 continues to be non-deductible obligations, nevertheless interest to your $612 became tax-deductible.

This tactic are pulled a step then: The fresh new tax-allowable portion of the attract paid back produces a yearly tax reimburse, that’ll then be employed to lower the borrowed funds even a lot more. This homeloan payment could well be 100% prominent (since it is an extra percentage) and can even become borrowed back into the entirety and you can committed to the same money-producing profile.

This new steps in the techniques is constant month-to-month and you can annual until the home loan is wholly income tax-allowable. As you can see on earlier profile additionally the next shape, the borrowed funds remains lingering in the $100,000, however the tax-allowable bit increases every month. The investment collection, quietly, continues to grow along with, by monthly contribution and money and funding growth you to definitely its promoting.

While the viewed more than, a fully tax-allowable home loan perform occur because history piece of prominent is actually lent back and invested. Your debt due has been $100,000; although not, 100% of the try taxation-deductible today. Yet, the fresh taxation refunds that are obtained might be spent too, to simply help boost the rates from which new resource portfolio develops.

What are the Financial Pricing from inside the Canada?

According to the Bank regarding Canada, the common rate of interest to possess good five-season old-fashioned mortgage are six.49%. The common costs for a around three-year and one-12 months antique home loan was indeed six.54% and you can eight.forty-two since .

Exactly how much regarding My Canadian Home loan Focus Was Tax-Allowable?

The attention on your financial is 100% tax-allowable for the Canada provided the house or property can be used getting financing earnings purposes. This is why the house or property should be hired out and you will generate local rental money for you (for the whole seasons) if you’d like to claim the fresh deduction to own mortgage desire.