Tax Deduction to your Mortgage Desire to have Reasonable Homes lower than Part 80EEA

Not as much as Area 80EE of Taxation Work, first-day homebuyers is avail of even more write-offs as much as Rs. 50,000. Which point is applicable to possess financing sanctioned up until 31st only. So you can claim so it financial taxation benefit, certain criteria should be met:

The loan number are Rs. 35 lakh otherwise faster, additionally the property’s value shouldn’t exceed Rs. 50 lakh. The borrowed funds need started approved between very first . At the time of financing approve, anyone ought not to individual other home, which makes them an initial-big date house owner. Please be aware you to Section 80EE is reintroduced it is appropriate simply for finance sanctioned until 31st .

Point 80EEA, brought on Relationship Finances 2019 to improve affordable casing, enjoy first-date homeowners to allege a taxation deduction all the way to Rs. step one.5 lakh to the attention paid for sensible construction financing. not, that it deduction has stopped being readily available for lenders approved into the or once first , given that gurus have been relevant only up to 31st . So you’re able to claim so it benefit, certain requirements must be came across:

Brand new homes loan have to have already been removed ranging from p obligation worthy of of your own residential household property should not surpass Rs. 45 lakh. Never individual any residential home property toward date of mortgage sanction. Never qualify so you’re able to claim an excellent deduction around Point 80EE of the Income tax Operate.

Deduction for Mutual Home loan

If you have a shared financial account, for every single debtor can directly allege home loan taxation experts to their nonexempt income. This is how:

? Appeal Commission: For every single debtor can be allege income tax benefits of up to Rs. 2 lakh into the attract reduced. It falls under Area 24(b) and additionally be proportional on percentage ownership of each co-candidate. ? Dominating Fees: Co-customers can be allege a great deduction as high as Rs. step 1.5 lakh contrary to the count reduced on dominating. The actual only real demands is that they need to be co-people who own the house so you’re able to claim such home loan tax pros.

For instance, if a couple individuals apply for a mutual financial, they can for every single claim doing Rs. 1.5 lakh and Rs. dos lakh on the prominent and interest payments, correspondingly. If each other applicants was earliest-time homeowners, capable on the other hand allege up to Rs. step one.5 lakh for every single, resulting in a mixed taxation advantage of as much as Rs. ten lakh, given they meet with the qualification criteria. Also, if they wish to allege more benefits around Section 80EEA out of the money Tax Act, a comparable principle applies.

Furthermore, adding a good co-candidate increases the qualification to have a higher loan amount. Lenders think about the fees potential and credit scores of all the co-candidates, making it great for incorporate together.

Home loan Taxation Great things about Getting a second Assets

If very first residence is care about-filled and also the second home is unused, each other features are believed notice-filled having tax intentions. Contained in this situation, taxation deduction will likely be reported https://cashadvancecompass.com/payday-loans-hi/ on the appeal purchased each other houses, nonetheless it dont surpass Rs. dos lakh in total.

Yet not, if the very first residence is thinking-occupied and 2nd you’re hired away, you must claim the brand new local rental earnings of 2nd property. Using this rental earnings, you could deduct the quality deduction from 31%, and additionally notice towards home loan and you will municipal taxation paid off, prior to figuring their nonexempt local rental earnings.

How exactly to Assess Taxation Experts into the Home loan?

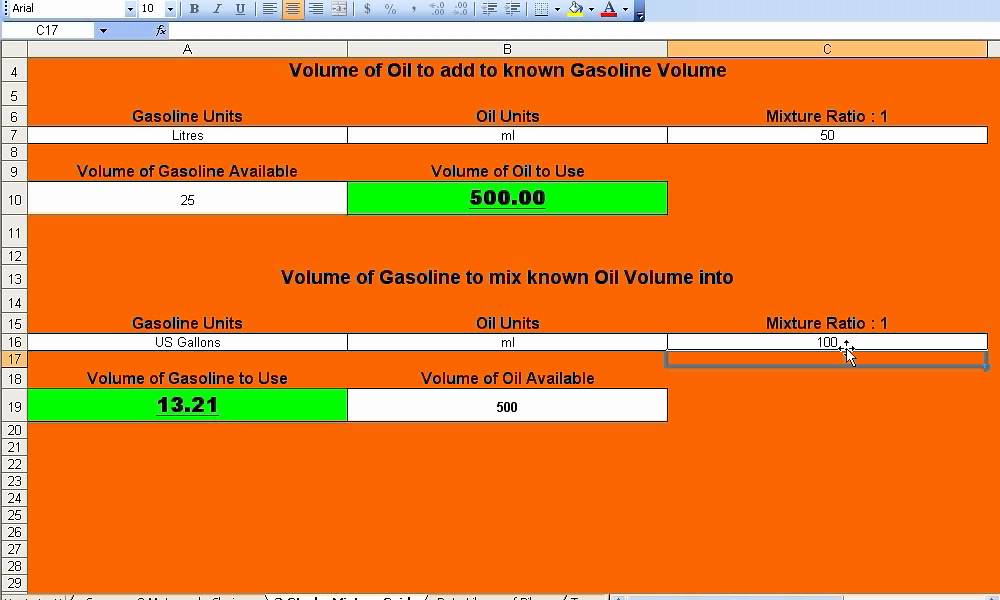

The most basic approach to calculate home loan tax masters is through an online calculator. Only input next facts: Loan amount, Tenure, Interest rate, Mortgage Initiate Date, Gross Yearly Earnings, and Established Deductions Less than Part 80C. Shortly after pressing «Determine,» you are getting an extensive description.