Its becoming even more preferred. How exactly to refinance your property, and you may purchase $0 at the closure to get it done

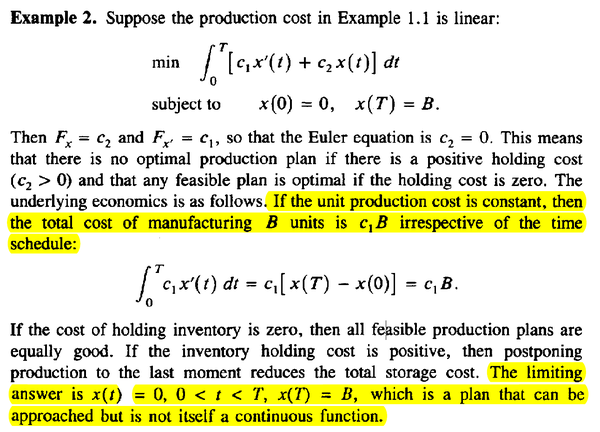

Alisa Wolfson

- Email address symbol

- Facebook icon

- Fb icon

- Linkedin symbol

- Flipboard symbol

Getty Photos/iStockphoto

Which includes home loan refi costs less than step 3%, most people are more than likely contemplating a good refi, however, wonder: Are you willing to refinance your residence with no currency appearing https://elitecashadvance.com/loans/payday-loan-consolidation out of your pouch at closure? Brand new short response is yes, but you’ll end investing the individuals closing costs on the roadway. (Find a very good financial re-finance pricing near you here.)

Closing costs on the refinances have a tendency to run-about 2-5% of your total prominent amount which you are obligated to pay, as well as the mediocre closing costs into the a good refi was over $5,700, according to analysis from fintech organization ClosingCorp. Settlement costs are often comprised of several costs anywhere between an enthusiastic origination fee, which the lender charge upfront to help you processes the mortgage application; an appraisal commission; identity research; credit history commission; and a lot more. Needless to say, discovering an out-of-pouch lump sum will make acquiring good re-finance burdensome for some somebody — that is why a zero-closing-pricing re-finance is a useful choice.

In some cases, those individuals fees are rolling to the mortgage from inside the what’s named a zero-closing-prices re-finance — meaning individuals don’t need to shell out things upfront out-of-pouch so you’re able to refinance. (Observe that you might have to buy an assessment even in the event: Generally you’ve got an assessment simply up front up front, another will set you back are covered toward the newest loan, claims home loan expert Robert Painter.) However, no-closing-rates refinances cannot mean a debtor was off of the hook getting all the expenditures, instead they might be only moved to the primary otherwise replaced getting a beneficial highest rate of interest. ( Compare today’s most useful home loan pricing here.)

Due to the focus on-right up home based rates together with expanding equity share one to home owners is actually standing on, what is actually becoming increasingly common ‘s the capacity to re-finance rather than expenses closing costs up front, constantly from the running the fresh new charges towards loan harmony, states Greg McBride, captain monetary specialist during the Bankrate.

The advantages of a no-closing pricing refi are clear: You don’t have to appear during the closing having a good evaluate. No-closing-rates refinances have existed for years because they real time upwards to their name. You are able to refinance and reduce the monthly mortgage repayment versus spending closing fees up front. Which is nice if your checking account is not full of 1000s of dollars to blow on refinancing costs, explains Holden Lewis, domestic and you will financial expert at NerdWallet. And you will, adds Painter: The largest professional of a no-closing-costs refi is when costs shed once again, you’re in a situation in order to refi once again with no prices and you can cut plenty.

But a no-closing rates re-finance can mean you get paying so much more away off wallet due to the highest interest rate. If you’re a person who intentions to stay in their property for extended, they most likely makes sense to invest the fresh new settlement costs initial, since you’ll be able to shell out men and women shortly after whilst you could well be expenses one to higher interest rate for decades ahead.

Otherwise plan to stay-in our home for very long, this could save you money, states Painter. That is because settlement costs is thousands of dollars, together with somewhat highest interest you happen to be purchasing this new zero-closure rates re-finance usually takes awhile to add doing what the latest closing costs would-have-been.

The latest no-closure rates refi also could make sense more, state, a home collateral financing in many cases: Just like the interest rates into mortgages usually are below house guarantee financing, a no-closing-costs refi often means that even if you have a higher rates, could result in expenses below you would with another financing. (Get the best financial re-finance rates close by here.)

Counsel, guidance otherwise reviews shown in this post are the ones off MarketWatch Picks, and have now maybe not been analyzed or recommended because of the our commercial partners.