Once you’ve used, you can usually predict a choice regarding lender within this a great month

Getting ready to accept top article the application form techniques is 50 % of the battle. You will most certainly you would like information about your own work and a personal fund declaration which have property and you can liabilities, and additionally information regarding the fresh vessel you want to purchase.

Down-payment

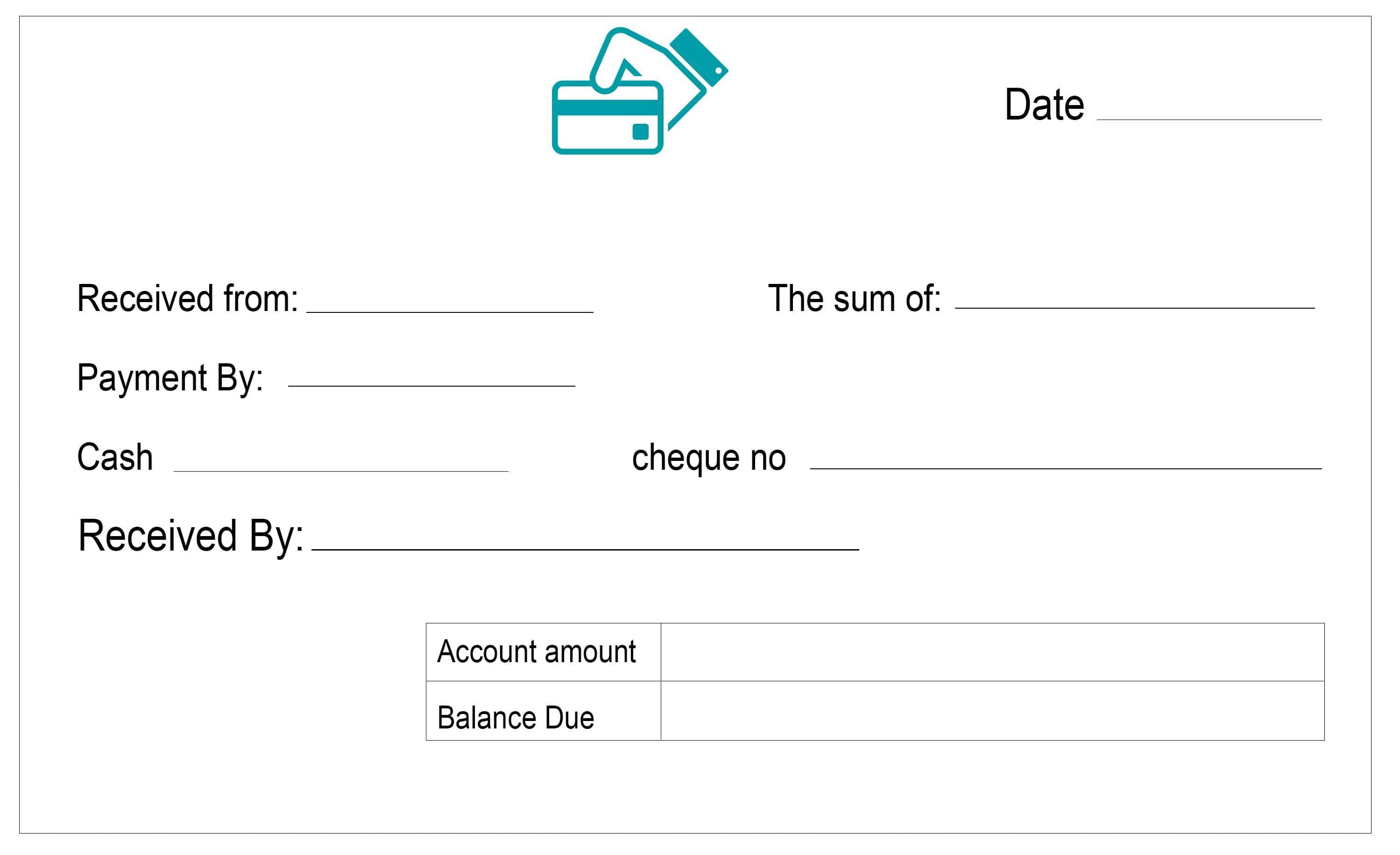

In the meantime, owner could possibly get ask you to put a down payment for the the new boat. Make sure to understand regards to the new down payment — would it be refundable if you fail to safer a loan, or select against the purchase? Talking about a few questions you should address before you could material a down payment. And, be sure you have a bill into down-payment, and additionally a plan of your regards to the fresh new payment.

Marine Questionnaire

And when you may be approved, your bank is always to wanted an aquatic questionnaire — this will be akin to taking a property examination before buying a beneficial family. Before a lender tend to keep the underwriting of your loan, they want to understand vessel is during good condition and you may may be worth brand new selling price. That have a marine questionnaire is great, but it’s also important to inquire of questions regarding the history off the newest motorboat and make certain the vendor listings any difficulties within the this new written transformation deal.

Closure and you can Resource

As aquatic survey is finished, of course, if new ship meets the fresh new lender’s standards, the seller tend to set an ending day. With this date, certain will cost you might be due, and there might possibly be multiple pieces of files is closed and you may notarized. If you are to purchase from a private people otherwise are only lookin for additional peace of mind, third-cluster escrow characteristics appear. As a consequence of these services, both you and the seller invest in terms and conditions. Then, you only pay the newest escrow solution, owner launches the newest ship and you’ve got the ability to make use of the vessel to have an agreed-abreast of period of time one which just render finally acceptance, where big date this new escrow organization releases financing to your provider.

Ideas to Financial support a yacht

- Check boat financing choices having finance companies, financial services people and you will borrowing unions. Do not forget to check out the marine loan providers through Federal Marine Lenders Connection.

- Contrast interest levels. Remember the fresh new terms and conditions from financing name or any other restrictions.

- Understand your loan versions: fixed-price, fixed-title, simple-attention, variable-rates and balloon fee.

- Be prepared for the application form processes. Ask your financial what needed and you may assemble all the associated models and you will information in advance.

- Seek advice concerning the reputation for the fresh ship. Get any dilemmas placed in new authored contract.

- Score a marine survey — very loan providers want so it as part of the underwriting techniques.

- Receive an acknowledgment regarding dealer/seller to own advance payment and you will a statement out-of sale out-of an excellent personal supplier into motorboat.

- Contemplate using a third-people escrow provider to own satisfaction.

- Be aware of the mortgage closing and you may funding procedure — the fresh new broker/merchant usually lay the new day, nevertheless should be aware of the costs owed you to definitely go out, as well as just what papers needs to get signed and notarized.

Financing Options for Your own Vessel

The whole process of how-to financing a yacht plus the tips to invest in a yacht are identical, regardless of which kind of mortgage otherwise money option you choose. Yet not, that does not mean every piece of information on these funding possibilities was unimportant. Opting for financing particular falls under the process, and it’s crucial that you understand what is actually available. Listed below are some of the very preferred finance to possess boats, together with certain record suggestions.

Home-Security Loan

If you have had your property for many years, then you possess some guarantee of your property and you will perform be eligible for property-equity financing otherwise personal line of credit to utilize to buy your vessel. The newest advantages of this kind regarding loan try you could make use of low home loan rates, and you may repayments in these sort of fund are often tax-deductible. The disadvantage is that you could need to legs the bill for an assessment, and you’ll features settlement costs. It can be unsafe since, in this form of loan, your property will get this new guarantee, meaning for folks who standard on your mortgage, the financial institution can also be foreclose on your own home.