Benefits and drawbacks of utilizing House Guarantee to fund Your organization

While you are undertaking otherwise broadening your company, there are numerous costs to adopt, out-of leasing property and purchasing equipment so you’re able to choosing and knowledge staff. While a resident, you may not has actually believed making use of your family guarantee to possess company funding, it can be a feasible replacement for a conventional small organization loan. Browse the pros and cons each and every from your options lower than.

SBA (Business Administration) Financing

A conventional small company financing, or SBA loan, is usually the first opportunity for most business owners looking to capital. Supported by the small Business Management, such loans are offered by banking companies, microlenders, and you will commercial lenders and sometimes feature straight down interest levels plus independence than old-fashioned bank loans.

Yet not, you to biggest issue out of conventional small business funds ‘s the reddish tape and you will files needed; of several require an individual investment make sure in order to support the loan. You need to remember that when your company is especially quick — say, when you find yourself the actual only real holder otherwise just one from several or around three employees — it would be particularly tough to safe a loan. Approximately just about fifteen% of only proprietorships keeps business loans.

Family Equity Mortgage to own Company

Property security financing enables you to borrow on the latest collateral you produced in your residence, utilizing the home to make sure the mortgage. To your as well as front side, this type of finance offer predictable interest rates, which means your payment continues to be the same monthly, and that’s specifically enticing if you’re looking to make use of a beneficial household collateral loan having organization intentions.

And in lieu of really team personal lines of credit, you aren’t expected to spend the money for equilibrium as a result of no per seasons. Actually, a home equity financing might be tempting for the essentially flexible installment symptoms, hence generally range from 5 so you can 15 years. In addition, it is possible the desire on the household guarantee financing have a tendency to be tax deductible.

not, a property equity loan was a second financial on your domestic, so you need to be happy to make a supplementary percentage on top of your existing financial. The program and you may approval techniques can also be a while challenging because of lenders’ specific conditions.

Family Security Personal line of credit (HELOC) to have Company

If you are looking having independence, an excellent HELOC for the small company is a good idea, whilst will give you the opportunity to availability financing any time and you may remove more as needed with no charges. The applying and you may acceptance process including are easier than additional options. Just as in a house security loan, there can be the possibility that the attention was tax-deductible, therefore the payment months typically spans off 15 to 20 years.

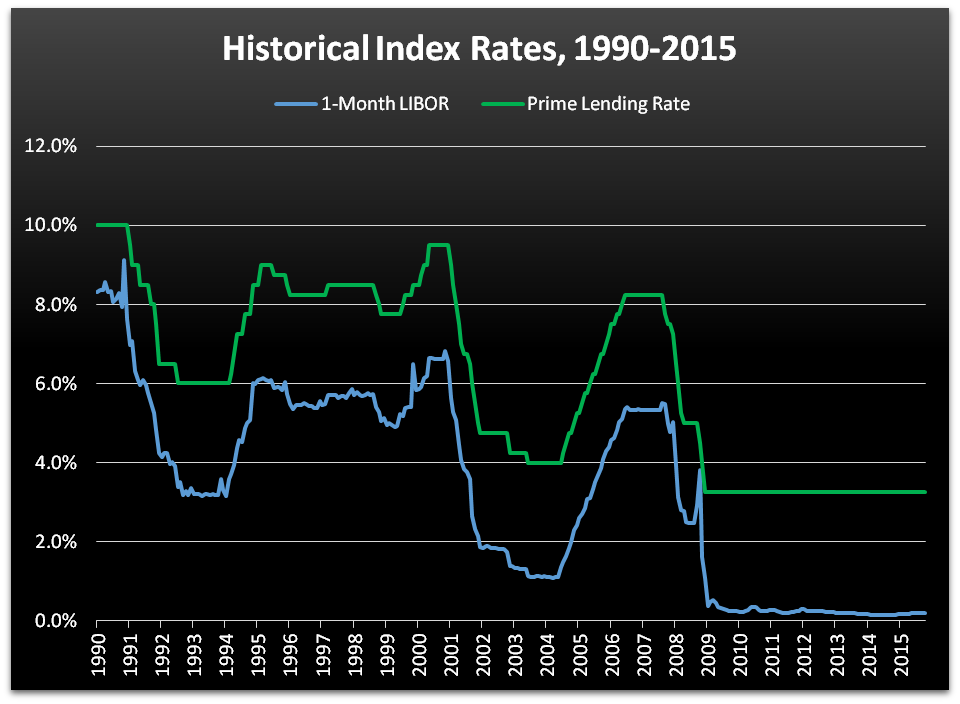

Yet , in lieu of a property guarantee loan which loans Brantley generally enjoys a predetermined price, this new varying rate of interest of an effective HELOC implies that payments tend to be volatile every month. Likewise, in the event the credit history otherwise domestic well worth decrease, the lender can frost your HELOC any moment.

Domestic Guarantee Resource

A home collateral investment offers money in change getting a good show in the future worth of your home, but instead of a loan or HELOC, you don’t have the effort away from monthly payments. You need to use the bucks to have anything you want, whether it’s to shop for gizmos, and come up with office renovations, or broadening operations. The fresh schedule is additionally apparently short, as soon as you may be approved, you could potentially found money within three days. 1 During the otherwise till the end of the ten-12 months effective period, you will need to settle this new investment — as a result of a beneficial re-finance, buyout that have discounts, otherwise sales of your home.

Along with domestic guarantee factors, a resident are putting their home at stake assured out of fostering the business’ victory. But what makes property collateral capital sometime unlike the other choices is the drawback safety it’s. In the event the home value depreciates through the years, the amount which is due in order to household collateral funding business instance Hometap in addition to decreases, and there’s no guaranteed go back towards the money. And you may alternatively, if the a home observes quick like, Hometap’s upside are capped at the 20 percent of your own Investment for each and every season.

Utilize your own collateral with no monthly payments. Find out if you prequalify getting an effective Hometap financial support in half a minute.

You have to know

I carry out the best to ensure that everything within the this post is as the precise as possible at the time of the latest date its wrote, however, anything alter easily possibly. Hometap cannot endorse or monitor one linked other sites. Individual products disagree, so check with your individual fund, tax otherwise law firm to determine what is reasonable for you.