Borrowing from the bank Sesame versus. Borrowing from the bank Karma: Which is the Right one for you?

This short article are subjected to an extensive facts-checking procedure. Our very own elite truth-checkers make sure post recommendations up against no. 1 sources, credible publishers loans Big Bear Lake, and you will experts in industry.

I found settlement regarding the services mentioned contained in this story, although viewpoints could be the author’s ownpensation get effect in which has the benefit of appear. I’ve perhaps not incorporated all the available issues otherwise now offers. Discover more about the way we benefit and our very own article formula.

Knowing your credit history can be a massive assist since you bundle debt future. Having the ability to track your credit score can help you get a hold of whether you qualify for certain lending products, interest levels, and you may features — and it may plus make it easier to determine your credit strengthening improvements to see crucial changes to the credit information.

Cheerfully, checking your own credit score wouldn’t hurt their credit. And ultizing an assistance including Borrowing from the bank Sesame otherwise Borrowing Karma is also help keep you near the top of your own borrowing condition. However, which ought to you utilize? Here’s an in-depth consider Borrowing from the bank Sesame vs. Borrowing Karma.

- Credit Sesame compared to. Borrowing Karma

- What exactly is Credit Sesame?

- What is Credit Karma?

- Credit Sesame vs. Borrowing from the bank Karma

- Summary: That ought to you choose?

What exactly is Borrowing Sesame?

Borrowing Sesame is a platform that provides credit score record, certainly one of most other services. When you create a merchant account, you can see your TransUnion VantageScore. Your VantageScore will be based upon a rating model created by the brand new three significant credit reporting agencies. This is certainly distinct from your own FICO score, that has been the industry important for a long time and you may is made because of the Fair Isaac Enterprise.

Bear in mind

You likely will get various other number when it comes to their VantageScore instead of the FICO get due to the fact algorithms utilized by for each credit rating model emphasize slightly something different.

Credit Sesame will give you a general thought of your own credit situation. New rating the truth is for the Borrowing from the bank Sesame was a base consumer score, there might possibly be variations in just what a loan provider notices if it look at the credit score after you submit an application for a loan. But you can however rating an idea if the credit score is right.

Which have Borrowing from the bank Sesame, you can even glance at different factors of the funds and also have helpful suggestions. The platform even offers various has actually. You can access some of these has at no cost, while some try rewards only available getting Borrowing from the bank Sesame+ registration superior account, and therefore prices $ otherwise $ thirty day period with respect to the plan you decide on.

Totally free credit rating

You could potentially found information away from Borrowing Sesame into the different factors regarding their borrowing and you may exactly what leads to your credit score. You will see yet another credit score every single day as it is up-to-date all 1 day.

Credit Sesame together with teaches you brand new feeling per grounds is wearing your get along with in which you already slide with every out of all of them — and you will your skill to alter.

Credit score announcements

You should check credit notice on your own Borrowing Sesame account since the well. For example information about after you discovered a credit rating boost, also when you are past due for the a repayment. Borrowing Sesame tend to identify unpaid membership and you can let you know how they might be impacting their rating.

Borrowing Sesame also offers cutting-edge choices for borrowing from the bank and you will identity overseeing. For the totally free type, you are able to only see alerts from a single borrowing from the bank bureau (TransUnion). For individuals who pay a fee every month from $, you can aquire credit monitoring into the three head bureaus.

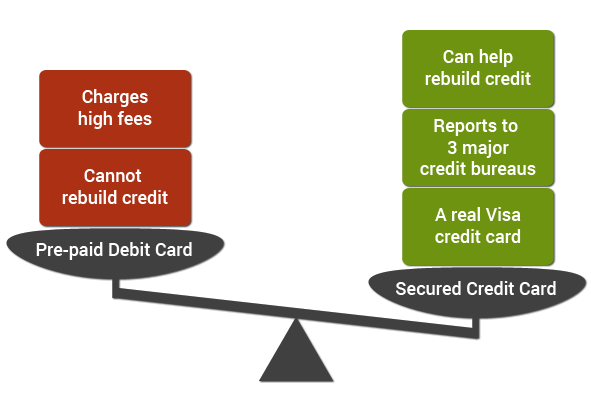

Sesame Cash

Credit Sesame also provides a good Sesame Cash prepaid service debit credit provided from the Area Federal Savings Lender. In addition keeps a cards builder choice, that involves opening a guaranteed digital credit card funded by the Sesame Cash credit.