Do i need to Score home financing As opposed to Tax statements?

Extremely conventional mortgages want taxation return income confirmation over the past a couple of years to show income. However, there are many different period where a borrower will most likely not need to provide taxation statements.

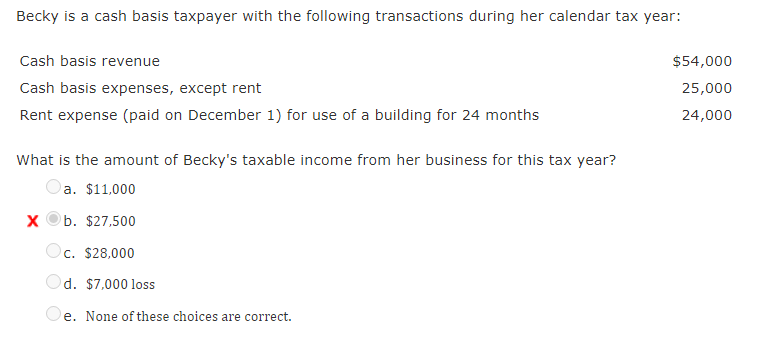

Except that confidentiality, people only don’t show adequate annual money to be eligible for a home loan to their formal tax statements, especially if he or she is mind-employed and take multiple generate-offs and you can team write-offs.

Mortgages To possess Practical Salary Earners

Very non-salaried otherwise hourly experts will need certainly to complete W-2s or pay stubs to confirm earnings for financial qualification. A lender may want evidence of a position both at software and you will before closure.

In the event you secure bonus pay in the way of overtime or added bonus spend, a loan provider will often need certainly to check if into manager. For those who earn more than twenty-five% of their pay when you look at the income, tax statements might still be needed.

Mortgage loans Getting Advertisers

In many cases, individuals who are advertisers or independent designers don’t let you know enough income on the yearly tax statements in order to qualify for a conventional mortgage. In such a case, a business owner may choose to get a financial statement financial.

A sequence of one to help you two years off lender comments tend to provide the lender a look out of monthly earnings that won’t fundamentally getting mirrored on a tax come back for an individual whom is actually mind-employed.

Certification Requirements for Bank Report Mortgage loans

- Self-work — To try to get a bank report home loan, the brand new debtor should be thinking-working or a separate company, however, does not fundamentally have to be truly the only manager away from the company.

- Confirmation of your businesses lifestyle — The company should have been in lives to possess a time period of at the least couple of years. The lender requires verification of your life of one’s organization that have a minumum of one of pursuing the: a business list, a business licenses, a web site, an enthusiastic accountant confirmation letter, 1099s, or other verifying affairs.

- Lender Report Requirements — Of many bank statement loan providers will demand 1 to 2 years of financial comments to choose an income. Normally, month-to-month places was averaged, having fun with each other dumps out of individual membership plus a portion out of places away from team profile. A borrower could be necessary to let you know money direction out-of the company bank account with the personal savings account.

- Advance payment Requisite — Various other financing issues keeps other advance payment criteria. While some need only ten% deposit, it does have a tendency to depend on the newest borrower’s other factors, particularly credit scores, earnings, money on hands, or any other property.

- Credit history Requirements — While credit rating criteria vary out-of bank so you’re able to financial, very loan providers want to see a get away from 600 or more. Other requirements like advance payment may boost otherwise decrease dependent to the credit rating of the debtor.

- Possessions — Underwriters are always looking for a lot more monetary facts, entitled compensating activities, which make a debtor a very attractive qualification chance. Significant economic assets is actually a strong compensating factor that create a great borrower more attractive so you’re able to a loan provider.

- Assets standards — depending on the bank, it is possible to finance a first home, next domestic, otherwise money spent from single-household members to 4 residential equipment. Cash-aside refinances can also be found.

Interest rate Variables

Given that a lender takes on higher risk which have a lender report financial that will not require all the usual confirmation papers, so it usually comes up regarding the interest. While each and every lender varies, you may be given other cost based upon your credit score and/or number of your downpayment.

Concerns? I have Responses!

When you yourself have a lot more questions relating to low-being qualified mortgage issues, contact the good qualities at the NonQMHomeLoans. You can expect a standard directory of home loan factors regarding old-fashioned so you’re able to personal investor mortgages.