Homepoint Economic Mortgage: All you have to Know

Insights Homepoint Economic Mortgages

Homepoint Financial is a prominent lending company in america, recognized for the commitment to delivering a wide range of financial services exceptional customer support. Whether you’re an initial-big date homebuyer, trying refinance your home loan, otherwise interested in an opposing financial, Homepoint Economic has the benefit of competitive cost and versatile terminology to meet up with your own requires.

Knowing the intricacies away from mortgages is essential when designing for example good tall economic decision. Off rates of interest and you may financing items to closing costs and you will payment selection, familiarizing yourself into the trick areas of a good Homepoint Financial Home loan can be enable you to definitely generate told solutions you to definitely line up with your long-identity economic needs.

Common Questions relating to Homepoint Monetary Mortgage loans

Navigating the mortgage landscape will likely be daunting, this is exactly why it is essential to get inquiries replied. Here are a few faq’s from the Homepoint Economic mortgage loans:

- Old-fashioned Financing: This type of finance comply with the guidelines set because of the Federal national mortgage association and you can Freddie Mac computer, providing aggressive cost and you will terminology to have consumers which have good credit and you can a constant credit history.

- FHA Funds: Covered of the Government Houses Government, FHA financing are designed for individuals having all the way down credit ratings otherwise quicker down repayments, generating homeownership accessibility.

- Va Fund: Secured because of the You.S. Agency out-of Experts Products, Virtual assistant loans bring positive terminology, and zero down payment options, for eligible veterans, active-duty armed forces staff, and you may thriving partners.

- Jumbo Finance: Surpassing the brand new compliant financing limits lay because of the Federal national mortgage association and Freddie Mac, jumbo loans serve individuals looking to investment for highest-priced characteristics.

- Re-finance Fund: Homepoint Financial also provides individuals refinance choices, making it possible for people to lessen their attention cost, shorten its financing terminology, or utilize the home’s collateral.

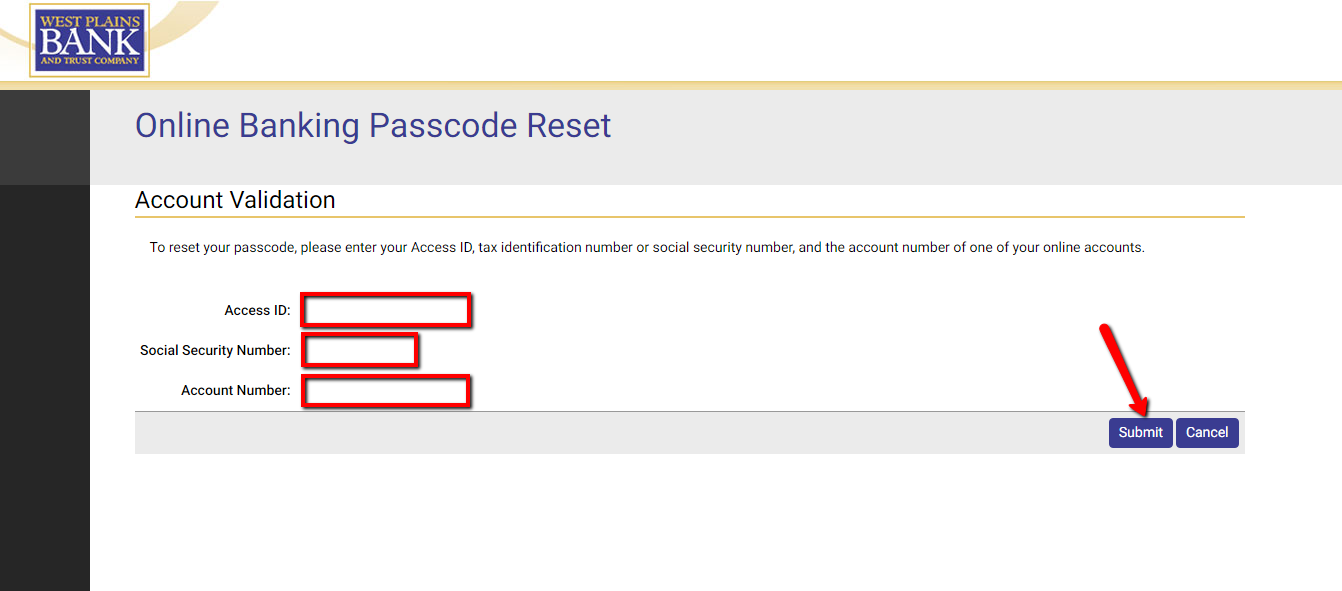

You can start the mortgage application process which have Homepoint Economic possibly online because of their representative-amicable webpages otherwise by calling certainly one of their educated real estate loan officials. Might guide you from requisite strategies, also meeting requisite paperwork, such as for example income verification, advantage comments, and you can credit file.

- Credit score: Increased credit score essentially causes a reduced rate of interest, showing the creditworthiness.

- Deposit: A installment loans no credit check Bakersfield bigger down-payment decreases the lender’s chance, possibly resulting in a lowered interest rate.

- Loan-to-Really worth Proportion (LTV): This new LTV is short for the proportion of loan amount to the appraised property value the house. A lower LTV usually usually means that a diminished interest.

- Debt-to-Money Proportion (DTI): The DTI, computed from the splitting your month-to-month debt money by the disgusting monthly money, implies what you can do to cope with most personal debt. A reduced DTI may be advantageous.

Very important Considerations to own Homepoint Economic Mortgages

step one. Home loan Insurance policies: Whether your deposit is actually below 20% of your own house’s cost, you may be expected to pay home loan insurance policies, and that handles the financial institution in case there are standard.

dos. Closing costs: Closing costs cover various expenses associated with signing your own mortgage, such as for instance assessment fees, term insurance rates, and mortgage origination costs.

step three. Escrow Membership: Their bank can produce an escrow account to cope with your residence taxes and homeowners insurance superior, making certain fast costs.

4. Prepayment Penalties: Certain mortgages will get hold prepayment charges if you opt to spend away from the loan early, making it important to ask for this type of potential charges.

Completion

Getting home financing is a huge financial milestone, and you can Homepoint Financial aims to help make the procedure because the smooth and transparent that you can. Because of the understanding the intricacies of their mortgage issues, examining the available options, and you may meticulously offered your debts, you can with confidence navigate the way so you can homeownership or re-finance your own existing mortgage having Homepoint Financial. Always compare cost, words, and you will fees off several loan providers to ensure you hold the extremely favorable terms for the novel facts.