Just how FHA Home loans Are different off USDA Mortgage loans

Home ownership is an aspiration for most and you can a need for almost all. A dream household shows beauty and you can deluxe. For all of us which need property for safety, they keeps them safe. Now both the casing fantasy as well as the significance of security can also be easily be came across, due to the Government Casing Government (FHA) and you can You Institution from Agriculture (USDA), several bodies enterprises that produce mortgage brokers cheaper. The secret to your housing fantasy try FHA lenders and you will USDA mortgages. An enthusiastic FHA mortgage is supported by this new You.S. Agencies of Construction and you can Urban Development (HUD), that was designed while making homeownership attainable for lots more members of the united states. The new USDA mortgage is designed to help household get home into the an outlying mode. Both funds is actually extremely beneficial, but really involve some key distinctions.

step 1. Deposit

The biggest concern getting an effective homebuyer when browsing get good house because of a home loan ‘s the down payment. Each other FHA and you may USDA mortgage brokers keeps relaxed deposit professionals. FHA finance need an advance payment out of the absolute minimum portion of the cost, while USDA home loans don’t need one deposit.

dos. Settlement costs

A vendor is needed to bear some percentage of this new closure prices for both FHA and you will USDA money on the leftover amount to get paid down by the consumer. From inside the FHA fund, maximum amount borrowed are inclusive of closing costs and should not meet or exceed an exact payment. While, inside an effective USDA loan, the newest debtor may a loan amount equivalent to the fresh new appraised worth of the house. The mortgage matter you are able to obtain from inside the good USDA loan are significantly more than simply an FHA mortgage.

3. Credit history

Each other FHA and you may USDA fund try liberal to the fico scores and you can a lot more forgiving than conventional finance. FHA finance want at least credit rating so you’re able to be considered. You can even have to pay at least deposit in the event that they drops on the a specific credit history assortment. The best thing about USDA money is that you do not have to worry about the minimum credit rating plus they run any debtor who can reveal that they are able to spend the money for the new financing.

4. Urban area Limits

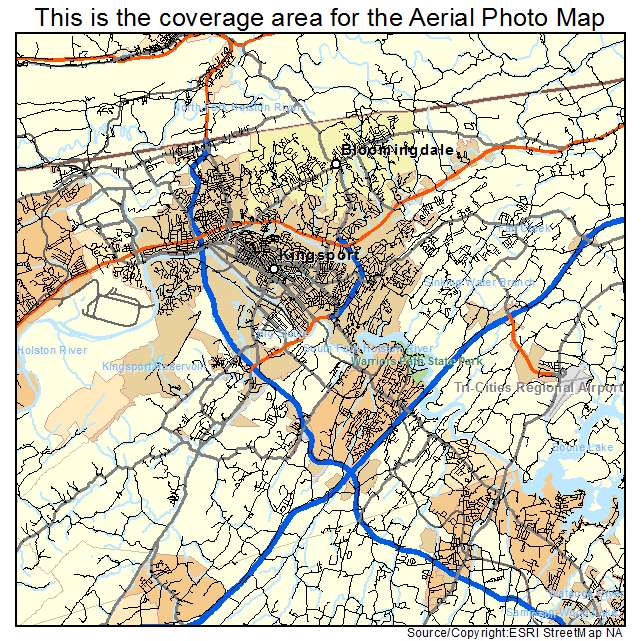

There are no geographic area limits for buying a house thanks to FHA loans. This means you can get property which is found everywhere (perhaps not confined to a particular urban area). USDA loans are available simply for those individuals functions which can be receive inside the a place accredited while the rural otherwise partial-metropolitan from the USDA. You happen to be surprised to understand that in which you may be life will come below outlying otherwise partial-urban location.

5. Income

Regarding FHA money, the greater number of money you will be making, the better the mortgage label. A guy making high money usually no wait cash advance Rockford AL means a lesser debt-to-income ratio. It denotes that you will be a lower chance for the mortgage lender. Additionally, the latest USDA financing is perfect for those individuals borrowers which do not has a high earnings. Which financing is targeted so you’re able to reasonable so you can center-money supports. USDA mortgage loans seek to build rural portion to possess families with low income, in lieu of to incorporate a loan and no advance payment.

If you’re looking getting a home loan company during the MA to greatly help your select the distinctions anywhere between FHA lenders and you may USDA financial fund, then Drew Mortgage Partners can help! Drew Financial Associates is actually an excellent Boston lending company that assists your identify a fantastic home loan you to definitely best suits your money. The house mortgage officials will help you with financial software that provide reduced-interest levels, low-down repayments, and you may shorter loan terms and conditions.