Signs and symptoms of an excellent Va Home loan Re-finance Ripoff

Experienced residents usually are the prospective out of dishonorable financial companies looking to when deciding to take advantageous asset of those who served our nation. Predicated on a consumer Monetary Security Bureau’s Va Warning Order, some predatory lenders are trying to single out experts with refinancing marketing that get off them even worse out-of. If you’re this type of also offers tend to arrive authoritative, they boost financing terms and conditions which can be very enticing so you can homeowners. Check out revealing cues the Va Financial Re-finance try a fraud to make sure that residents will be conscious of it and prevent falling prey to help you dishonest lenders.

Low-Interest rates Without Certain Terms

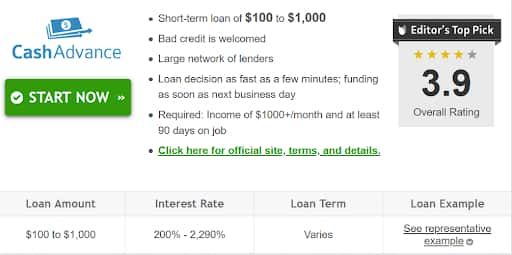

Specific loan providers use misleading, eye-finding lower-rates of interest inside their ads. The latest advertised prices is generally lower versus homeowner’s current rate of interest; yet not, they might trigger higher monthly obligations.

- Apr (APR).

- Installment several months (elizabeth.grams., fifteen or 3 decades).

- Brand of mortgage.

- Write off points regularly reduce the rate of interest.

On the other hand, interest levels are very different certainly one of lenders. The reported rates is a reported rates. The genuine interest rate relies on individuals affairs, in addition to credit score.

15-Year versus. 30-12 months Fixed-Rates Financial

An effective 15-12 months fixed-price mortgage (FRM) usually has a diminished rate of interest than a 30-seasons fixed-rate financial, nonetheless it has actually increased payment per month as dominating are paid-in 1 / 2 of the time (180 monthly obligations unlike 360 months).

Bellamy payday loan cash advance

Some Virtual assistant financing refinancing cons leave out the mortgage terminology to secret home owners toward thinking he or she is taking a great deal on a 30-seasons mortgage, which in the course of time results in high monthly obligations just like the financing try in reality to own 15 years.

Fixed-Rates Home loan vs. Adjustable-Price Financial

A varying-speed financial (ARM) may have a lower life expectancy interest rate than simply a fixed-price mortgage at the beginning of the loan (intro speed), nevertheless interest rate adjusts will eventually and may also disperse up.

Misleading Virtual assistant lenders can also be advertise these types of refinancing money so they appear to have lower monthly premiums about entire loan. In actuality, in the event, the rate can go up considerably, pressing this new payment high and higher.

Property owners should always be clear about the type of mortgage a great lender advertises and determine out to possess mortgage loans you to definitely sound too-good to be true.

Write off Activities Maybe not Revealed

For each part will set you back step one% of your own loan amount. Such as for example, into the a great $300,000 financing, an economy point will set you back $step three,000 and might reduce the interest from the 0.25%, leading to high savings.

Misleading adverts strategies might not reveal that financing boasts to order what to lessen the rate of interest, driving up closing costs because of the several thousand dollars.

Offers One to Promote Bypassing Mortgage payments

The latest Company regarding Experts Issues prohibits loan providers out-of advertisements this new skipping from money as a way of having money in an attraction Rate Reduction Home mortgage refinance loan (IRRRL).

Certain lenders nevertheless make use of this because the a selling point once they can’t provide bucks-aside otherwise a somewhat lower rate of interest, according to .

Offers to Discover an enthusiastic Escrow Reimburse

Seriously, in the event, the amount in escrow in the event the mortgage shuts and you can at all prices are paid off can’t be recognized for adverts intentions. Multiple parameters can impact the amount of money from inside the escrow on closure.

Out-Of-Pocket Refinance Has the benefit of

CFPB says this of your inaccurate adverts used with Va re-finance funds is the fact there are no away-of-pouch can cost you. These lenders produces the brand new offer appear to be refinancing is free.

Particular lenders’ deceit is the non-revelation that the closing costs was folded toward mortgage; thus, the debtor is financial support the expenses. Additionally, lenders both pay the settlement costs and charges increased attract speed to recoup the cost.

Lastly, property owners is always to look out for competitive conversion process plans. When the a deal really does stand-to work for a homeowner, it’s unlikely a loan provider commonly stress these with calls, emails, and messages.

Marimark Home loan

I concentrate on mortgage loans for very first-day homebuyers, old-fashioned mortgage loans, FHA, Virtual assistant, and you will USDA mortgage selection, re-finance funds, and you can contrary mortgages. We worked extensively which have cash-aside refinancing and help readers to lower their monthly mortgage repayments.

To begin which have a mortgage order your second family, excite submit our Quick Mortgage Software otherwise contact us.

This new Marimark Financial Publication helps to keep your advised which have extremely important incidents throughout the mortgage business that may impression your bank account.

We especially manage a way to save well on your and upcoming mortgages. And you may, i continually share all the details i tell our very own customers, since the we believe told ?ndividuals are an educated people.

Realtors, or other professionals in the market, can get a continuing useful suggestions which can help you all of them serve their clients.