step three.dos Earnings boosted by highest rates of interest, once the financial business face bumpy prospects

Rising interest margins helped help the profits of euro urban area banks inside 2022, particularly in countries having large amounts of adjustable-rate credit. The aggregate go back for the security (ROE) out of euro city high organizations (SIs) rose because of the 1 percentage point a year ago to help you 7.6%. In contrast which have 2021, whenever a reduction of loan loss conditions is actually a portion of the basis behind improving success, the advance inside 2022 try mainly determined because of the higher core profits (Chart step 3.5, panel a good). Focus margins surged on the back of the large rise in rules rates of interest from the summer out-of just last year, if you find yourself finance companies adjusted the put rates much slower. Margin expansion had a tendency to be highest in those places which have a great larger show out of financing granted at the variable rates of interest, however, additional factors along with starred a task, like banks’ hedging actions as well as the rate of interest character additional new banking publication. As well, credit volumes made a positive sum to help you growth in online notice income (NII) for the majority regions when you look at the very first three-quarters out of just last year (Chart step three.5, panel b, correct graph). On the other hand, NII flower smaller highly from inside the places such as for instance France in which fixed-speed financing predominates and you can banking institutions had currently enhanced put pricing in order to a much bigger the quantity. Web payment and you will percentage money (NFCI) together with increased, even though in the a much slower rates compared to 2021, when you find yourself costs went on to go up (Graph step three.5, panel b, kept graph). Earliest quarter 2023 income outcomes for listed banking institutions suggest that even with straight down trade income and better will set you back, profits improved further on the rear out of high NII.

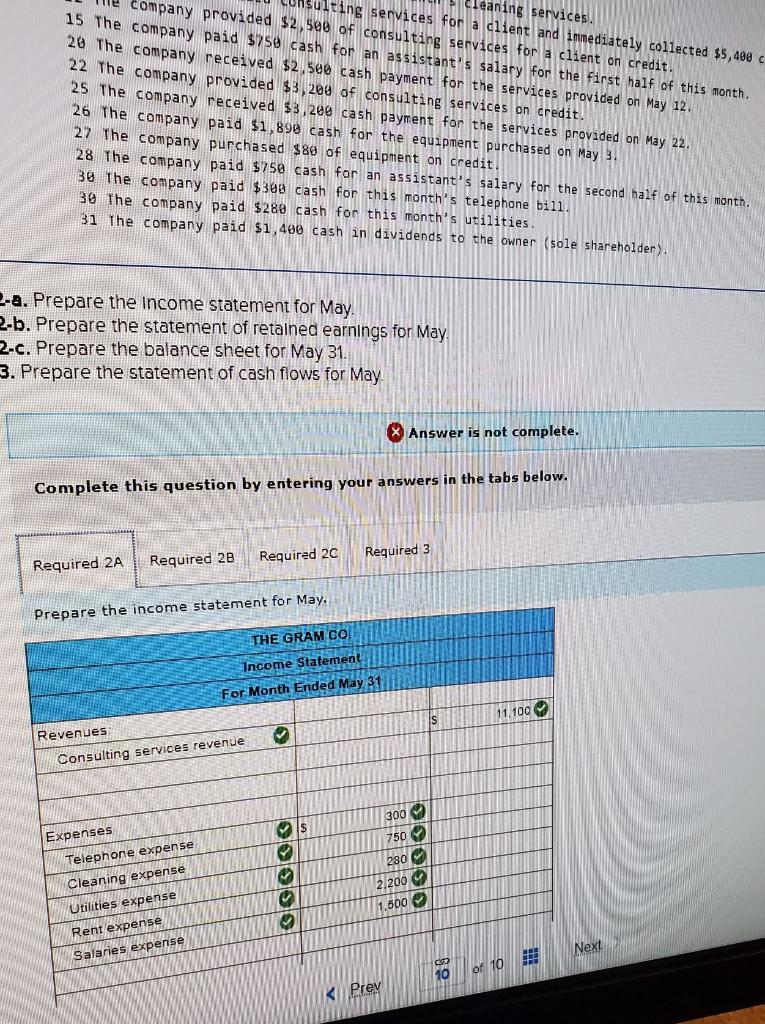

Graph step three.5

Bank success improved next into the 2022 on the rear of healthier net desire money passionate because of the highest margins, particularly in nations having varying interest rates

Sources: ECB and ECB calculations.Notes: considering a well-balanced attempt away from 83 euro area tall associations. Committee b: the brand new display of financing at changeable costs is dependant on new organization amounts and title loan rates Florida makes reference to financing that have a variable interest and you may mortgage loan fixation age around 12 months. NII signifies net attention money; NFCI is short for websites percentage and payment money.

In spite of the banking markets fret inside the ics, field experts anticipate euro urban area bank profits to improve next inside 2023. Industry hopes of the future aggregate ROE off listed euro city banks to possess 2023 was basically revised upwards sizeably since the start associated with seasons, which have ROE projections increasing regarding 8.1% to 9.2% between your end regarding this past year and also the beginning of February (Chart step three.6, committee a great). The majority of which upgrade was motivated of the highest requested NII for the a breeding ground in which interest forecasts was indeed revised to stay large for extended, more offsetting the possibility perception away from firmer borrowing from the bank requirements and you can subtle lending progress. Expectations of lower impairments portray a second important self-confident factor, highlighting an upgrade regarding euro urban area macroeconomic outlook because start of in 2010. The new compressing within the banks’ sector valuations inside the February and higher bank resource can cost you did not frequently weigh with the financial success as ROE standard enhanced subsequent in order to 10.6% at the conclusion of Will get. The extra upward revisions out-of ROE criterion as February should be blamed primarily to better NII, along with lower costs, large NFCI and lower problems. Financial experts might enhance its ROE forecasts down in the years ahead, given most tighter lender financing standards, a beneficial slump during the mortgage consult and much more muted credit dynamics to possess NFCs in particular for that reason (Graph step three.six, panel b).

Graph step 3.six

ROE projections having 2023 was modified right up strongly in 2010, even with stronger borrowing from the bank requirements and simple growth in credit to help you NFCs particularly