Wells Fargo Lender keeps felt like having finality to close off their range regarding credit profile so you’re able to express certain device products

The fresh revolving lines of credit greet profiles in order to acquire $step three,000 so you’re able to $10,000, which they use to combine high-attract charge card costs, home loans, or stop overdraft charges.

Wells Fargo has power down loads of characteristics because good results of the fresh pandemic. It stopped the home security financing inside 2020 and you can would stop providing automobile financing in order to independent dealerships. The latest bank’s faqs (FAQ) webpage indicated that the brand new account closures can not be analyzed or reversed.

I apologize to the inconvenience it line of credit closing often bring about, the financial institution said within the a six-page page in order to consumers. New account closing try finally.

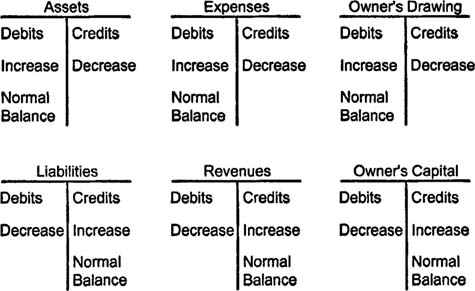

Lenders love to come across a cards utilization proportion regarding 30% otherwise shorter

Fortunately, there are more choice available for the shoppers looking able dollars. They can turn-to most other lenders offering lines of credit or private payment funds such as for instance domestic loans.

The lending company said, We know change would be inconvenient, specially when customer borrowing may be inspired. We are taking an effective 60-go out observe several months which have a few reminders prior to closure. We have been dedicated to let for every consumer pick a card provider that meets their demands.

The headlines can impact the financing utilization proportion regarding consumers or the fresh portion of the credit they are playing with. It does negatively impact their credit rating, since the overall available borrowing from the bank will go off, because number of financial obligation will continue to be a similar.

Rachel Gittleman , financial characteristics and you will registration outreach director at User Federation from America said the customers whose lines of credit are closed need to keep track of their credit reports and you may results. Whether your available borrowing from the bank goes down considerably inside a brief period, this may negatively feeling an individual’s credit history. Members exactly who come across a drastic change is also grumble on the Consumer Economic Safeguards Bureau , she told you.

Customers exactly who want to alter the Wells Fargo personal line of credit that have another type of loan need to make an informed purchase by examining the item costs.

It’s not just the annual percentage rate (APR), you can find monthly or annual charge and that is section of what you’re repaying. Due to the fact a customer, you have to make yes you’re able to spend one, she additional.

Wells Fargo will be sending users an excellent sixty-day see up until the personal line of credit are canceled. Once they shuts, the remainder balances will get minimum monthly payments and you may a predetermined interest. Minimal commission could be step 1% of your own kept balance or $twenty-five, any sort of, was highest. The bank possess yet and make a proper announcement towards mediocre repaired rate of interest. The newest changeable interest varied away from nine.5% so you can 21%.

The credit use proportion of people may likely increase whenever their account are finalized

Most of the individual is going to enjoys different means. Make certain that it is something you are able to afford on a monthly basis on top of your typical costs. Gittleman said.

Lines of credit are often always make big commands such as for example consolidating debt or making home improvements. The eye costs inside the credit lines are mostly variable which means they could changes shortly after a predetermined months.

If you intend to stay that have Wells Fargo, you could potentially like playing cards or signature loans. You can prefer a line of credit from other associations and there is numerous selection.

Playing cards also are thought the newest rotating line of credit since you can be withdraw from a line of credit while making payment for a different sort of. You always hold a lower borrowing limit with a charge card versus a credit line. A charge card can be used and make shorter sales.

A consumer loan would-be a predetermined amount that you can pay back with a predetermined interest rate plus they means much like credit lines. Both of them are used to make big requests and can have a great effect on your credit rating if one makes prompt money. A personal bank loan is a great solution if you’d like a predetermined number and they are comfortable with a reliable fees agenda.