Your credit score and you will credit rating is important portion for the a beneficial lender’s acceptance choice

- Incorporate Monetary Abuse : Stop beginning any the latest personal lines of credit and lower the the debt financial obligation during the last 90 so you’re able to 120 months just before your mortgage shuts. The prospective are stable, predictable finances.

- Get ready for the brand new Worst, Funds Ahead : Loan providers get undervalue settlement costs, therefore putting aside an economic support (if at all possible step 1.5% of one’s purchase price) can possibly prevent shocks. Very carefully feedback their lender’s rates.

- Thought a talented Co-Signer : Whether your economic reputation are borderline, including a reputable co-signer offer lenders extra encouragement to help you award pre-approvals.

- Job? Sit Lay : Unless their mortgage broker advises or even, stop people volunteer a position changes immediately after pre-recognition which could destabilize your income stream.

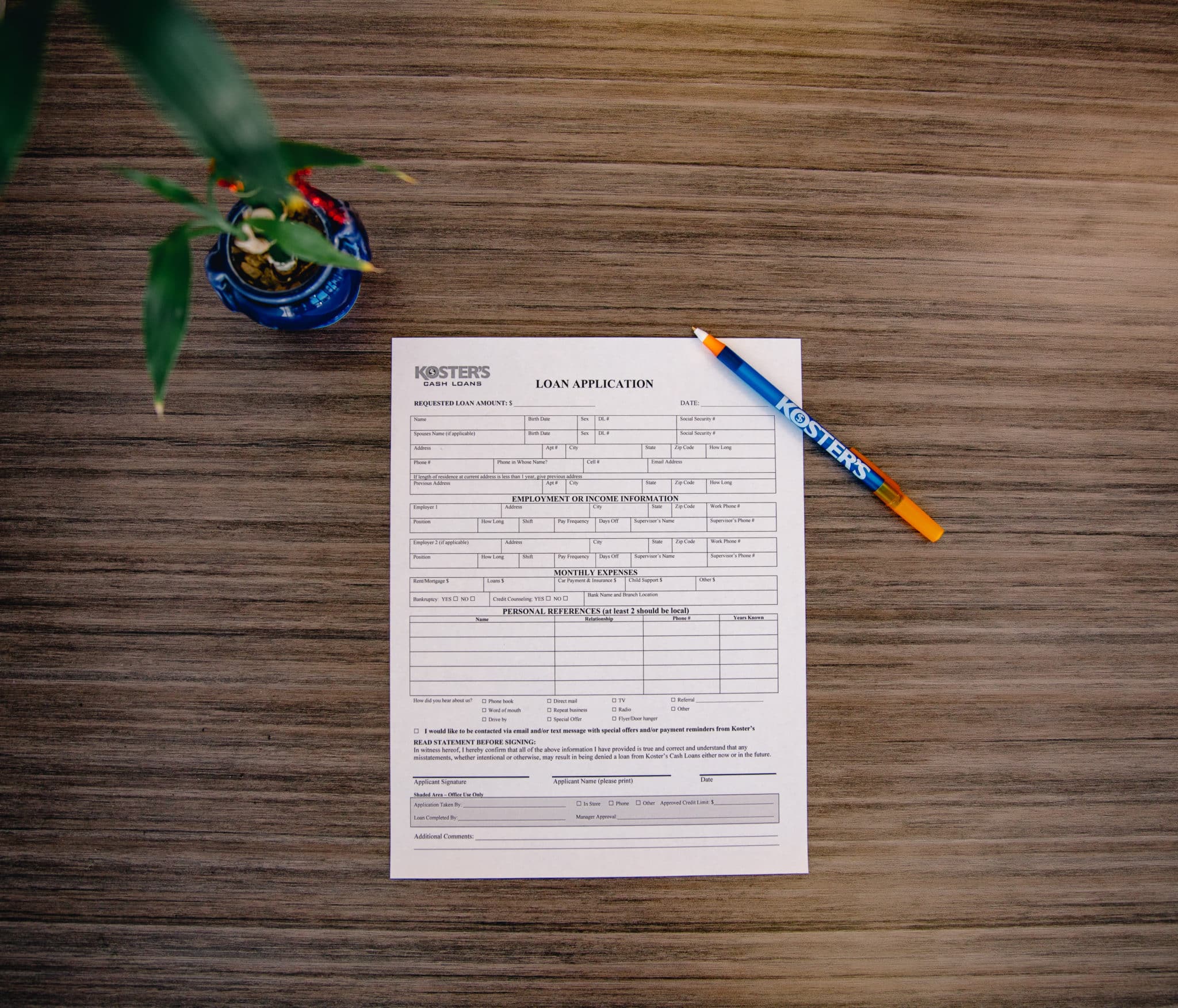

- Document, File, Document : Maintain clean documents for the money, assets, expenses, and work info to help you facilitate bank confirmation. Give a reasonable report trail.

- Cultivate The Credit rating : Oriented borrowing behavior and you can solid credit scores continuously rank among most readily useful bank concerns. Cover the tough-earned get vigilantly.

- Discover Correspondence together with your Financial Cluster : Transparency is paramount. Proactively increase any potential warning flag together with your large financial company when you find yourself there is time for you proper.

Frequently asked questions

If for example the mortgage loan doesn’t located finally recognition on the bank until the scheduled closing big date, you risk not being able to conclude the home pick. The vendor may just be sure to keep your serious money put otherwise also grab legal action. Getting your mortgage rejected during this period can also be derail the entire a residential property deal, it is therefore crucial to really works closely together with your large financial company and you can agent to end any last-moment factors.

Lenders often very carefully review your financial statements and you will membership activity so you can make certain your earnings supplies, coupons models, and you will full financial routines. One large, unexplained deposits or withdrawals might possibly be named chance points and you can prompt more records demands. Keeping stable bank account is important.

Really lenders enjoys certain credit rating standards, assuming their score falls too low immediately after pre-recognition, you’ll be able to deal with denial or maybe more rates of interest. In addition, the newest negative factors on your own credit report for example late payments is raise warning flag.

A talented real estate professional may help put reasonable standards as much as properties’ potential appraised values considering their regional business possibilities. Since the a decreased appraisal one to boosts the loan-to-really worth proportion is a common factor in mortgage denials after pre-recognition, having an agent render guidance on new home’s projected appraisal is invaluable.

A reasonable financial appraisal has a worth of that’s on otherwise https://elitecashadvance.com/installment-loans-ca/ over the agreed purchase price. In case the bank’s appraiser philosophy our home less than the purchase price, it could lead to the lender doubting the borrowed funds or requiring more substantial advance payment to pay towards the enhanced financing-to-well worth proportion.

Having your mortgage declined on last second is going to be a great nightmare condition. At that phase, the choices are normally taken for getting a beneficial co-signer, selecting an alternative bank (with the help of an agent), or sadly walking aside and you will dropping any serious money dumps already paid off. Building a financial support to possess unanticipated closure costs offer a shield too.

Your credit rating impacts both your odds of mortgage approval and you can the eye rates you’ll qualify for. Most loan providers provides get thresholds, in which consumers having ratings less than a certain benchmark (tend to from the 600s) deal with more than likely denial otherwise high desire costs. Boosting your credit score offers a lot more bargaining strength.

Summary

A mortgage denial is among the greatest factors a house profit slip thanks to and why unnecessary consumers look to Clover Home loan having assistance with an easy closing last-minute home loan. It can also be incredibly difficult for an already accepted borrower to own the financial removed from them from the extremely last time, since into the can indicate that they’ll treat the house or property and you can put.