Zero Settlement costs or Handling Fees. Ever

A home guarantee credit line spends this new equity you created of your home so you’re able to acquire into unanticipated otherwise in the long run upgrade one dated toilet. The new security of your house will depend on deducting extent you borrowed from on any mortgage otherwise fund which can be safeguarded by your home from the current market value of your home. Having a first Commonwealth Lender FlexChoice household security line of credit, you have the self-reliance to draw from your line to access cash as you need it, in both small or large numbers. Is an instant movies having Ashley, our lenders, to describe:

A property equity credit line instead of a house security mortgage try your own choice predicated on your financial situation. Which have property collateral personal line of credit, you can access use area of the amount today or at any time inside name of the range. The range will get an adjustable speed and you may only build repayments on number you use (otherwise draw) out of your line. Having a house collateral financing, you receive the complete matter requested that have a fixed price title and you will commission.

With your FlexChoice Domestic Equity Personal line of credit, it’s not necessary to pay closings will set you back otherwise handling charge dos , which can generally include $475 so you’re able to $915 . This means that it is certain you’re getting many from the mortgage for your financial journey.

Common Spends out-of a home Equity Line of credit

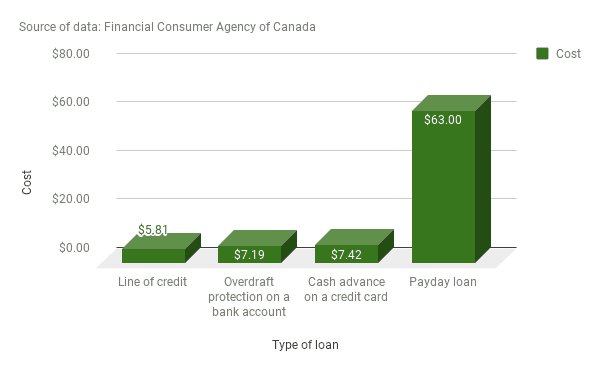

- Consolidating Loans with the guarantee of your home will be a strong way so you’re able to consolidate several highest-attract expenses, and you will a property unsecured personal installment loans in New Castle guarantee credit line helps it be happens.

- Emergencies in place of a house collateral mortgage, which have a property guarantee personal line of credit, you simply create repayments after you mark on your own range. This makes a house security personal line of credit a very helpful product if there is problems. If unexpected happens, you really have depend on realizing that you have access to currency via your household guarantee credit line.

- Home improvements use property security personal line of credit to consider house improvement tactics that create well worth to your residence, such an updated restroom otherwise kitchen.

Domestic Guarantee Line of credit Cost & Keeps

- No settlement costs otherwise operating charge step one

- Available for credit lines from $ten,100 to $500,000

- A fixed interest rate secure fee choice allows you to convert a portion of what you owe so you can a fixed rate of interest getting an expression from step 3 so you’re able to 2 decades

- Acquire up to 85% in your home security while the an initial otherwise next lien

- Availableness your own finance by see, mobile, on line, or at the a primary Commonwealth workplace

- Create automated costs from your First Commonwealth family savings

Home security line of credit cost are very different based on issues for example your credit rating, exactly how much security you have got and just how far you will want to acquire. Immediately, i have a different sort of 2.49% Annual percentage rate to own half a year and this changes in order to as little as 5.99% Annual percentage rate step one .

Making an application for A property Collateral Line of credit

Make an application for a property collateral credit line utilizing your mobile, tablet or laptop computer. The audience is along with offered at to utilize over the telephone, or get in touch with a location workplace in order to schedule a scheduled appointment. This is what needed once you apply for your property equity personal line of credit:

If you’re a preexisting mortgage buyers and want to create a-one-time or repeated commission, visit the On the internet Financing Percentage web site.

Household Collateral Personal line of credit Calculators

Discover before you could obtain that with our home collateral distinctive line of credit calculators, and additionally How much cash Often My Loan Repayments Become and just how Far Can i Be able to Obtain?

Family Equity Loans

step one Following the 2.49% Apr (APR) 6-month introductory months, this new Apr with the a house equity personal line of credit might be a varying speed based on Wall surface Highway Record Perfect Price (6.25% at the time of 9/) and or minus good margin (already as low as Perfect Speed 0.26% otherwise 5.99%). The most rates try 18% together with equipment floor speed is actually dos.99%. Best get changes any moment and is susceptible to alter without warning. The basic months initiate on date out of account opening.

After the introductory period stops, every left balances commonly instantly convert to the fresh new variable Apr per the new terms of the home Security Credit line agreement. To help you get the given rate, at least $ten,000 in the newest money and you will head debit away from financing payment away from a first Commonwealth Bank checking account is necessary, or even the interest rate might be 0.25% high. An earlier cancellation fee out of $five-hundred or 2% of the range amount, any type of was faster, can get implement in case your range try signed inside 36 months regarding account starting. A yearly Payment off $50 could be energized into line of credit. Good $75 rates secure or unlock fee are recharged for many who use the price lock feature to convert a fraction of your own equilibrium between a varying speed and you may a predetermined rates. If a deed transfer is necessary, name insurance policies and attorney’s fees may be required. Taxes and assets insurance coverage will always be necessary and you can ton insurance policy is requisite where necessary. Consult your taxation advisor concerning deductibility interesting. Other prices and you can conditions are available. Promote legitimate to have apps . Give susceptible to change otherwise detachment any moment.

To have domestic collateral lines of credit having principal and interest payments, give would depend through to fund $10,000 to help you $five-hundred,000, a loan to well worth doing 85% on the a proprietor-occupied no. 1 home, subject to credit recognition, and cannot feel a purchase money mortgage.

To own household collateral credit lines having interest simply payments, promote depends upon fund $ten,100 in order to $500,100, financing to help you really worth up to 80% for the a holder-filled number one house, susceptible to credit recognition, and cannot become a purchase money home loan. Notice just money often convert to principal and you can attract repayments at the the conclusion the latest 10 season draw period.